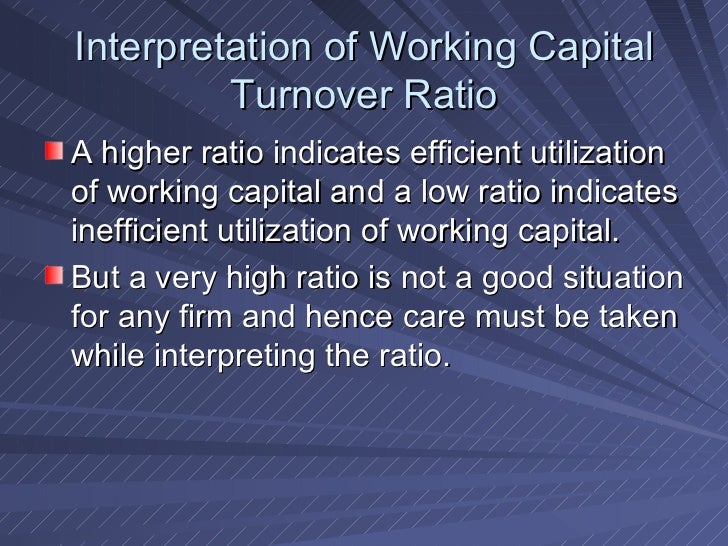

Meanwhile, a low working capital turnover ratio could point to inefficiencies as the company is not generating a significant return on its assets, which can signal financial difficulty. This lack of liquidity could mean that the company would struggle to pay all of its debts.

Being top-heavy on fixed assets brings the available working capital down and means that the company lacks liquidity. If the ratio increases significantly over the years however, or seems excessively high in relation to sector peers, this could indicate that the company is overtrading, ie taking on large orders that it does not have the resources to fulfil, and/or that a high proportion of the business’s assets are fixed assets (ie long-term assets such as buildings and machinery that are not easily converted into cash). However, in general, a high working capital turnover ratio usually indicates that the company is actively generating sales from its working capital, which is a positive indicator of future prospects.

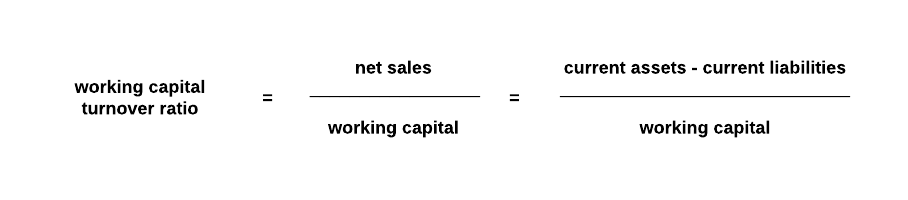

Interpretation of resultsĪs with the majority of turnover ratios, the results should be interpreted on an industry sector basis to provide an accurate benchmark. This means that during the period, the company has used (and of course replaced) its working capital 4.5 times to generate sales. Using the above equation, company XYZ’s working capital turnover is: 189,445 85,361 – 43,262 = 4.5 ExampleĬompany XYZ’s net sales year-to-date are €189,445, its current assets are €85,361, and its current liabilities are €43,262. Current liabilities include accounts payable and payroll as well as any other liabilities, eg taxes, due in under a year. Current assets include inventory and accounts receivable together with all other assets that will be held for less than 12 months. Working capital is generally calculated as the company’s current assets less its current liabilities. The ratio is sometimes known as the capital turnover ratio, as net sales to working capital, or by the acronym WCTO. As such, the ratio is a good indicator of company growth and liquidity and is calculated as follows: Working capital turnover = net sales working capital The working capital turnover ratio is an activity ratio that measures how many times working capital is used to generate sales, ie revenue, during a specific time period.

#WORKING CAPITAL TURNOVER RATIO SERIES#

This month, in the last of our series on turnover ratios, we examine the working capital turnover ratio.

0 kommentar(er)

0 kommentar(er)